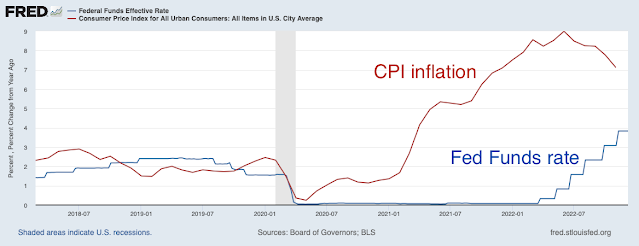

The November CPI is in, and inflation continues to moderate despite interest rates that, while rising, are still below current inflation. The great experiment seems to be working out, at least for now. (Previous post, with links to earlier writing.)

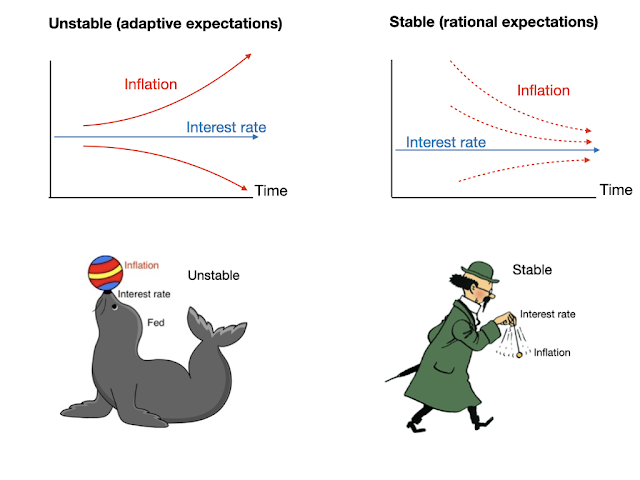

As before, the first great question, which economists really don't have a consensus answer to, is whether inflation is stable or unstable; whether it takes a period of interest rates above current inflation to bring inflation down, or whether inflation will eventually follow the interest rate.

(Yes, I've used this picture several times before, but it's too much fun not to use again.) In the conventional "adaptive expectations" view, inflation is unstable, like the ball on the seal's nose, unless the Fed moves interest rates quickly, and inflation will spiral away unless interest rates rise above the current rate of inflation. In the more radical "rational expectations" view, inflation is stable and will eventually go away on its own even if the Fed does nothing. (So long as fiscal policy doesn't add fuel to the fire. Also, it allows for more dynamics; inflation can go up before coming back, and the long run can take a long time.)

The experiment, like the zero bound era, seems to be coming in on the side of stable.

What about the Fed's rise in rates? In the models I play with, that will help in the short run, but at the cost of stubborn more entrenched inflation eventually. To recap, here is the response of a simple fiscal theory model to a fiscal shock -- deficits that people do not expect to be repaid -- when the Fed does nothing (top), and to a monetary policy shock -- persistently higher interest rates with no change in fiscal policy -- (bottom).

In response to the fiscal shock, we get a drawn out period of inflation. The negative real interest rate (interest rate below inflation) slowly eats away at bondholder's wealth until they have, in essence, paid for the initial deficit. In response to higher interest rates, with no change in fiscal policy, inflation initially declines, but then eventually follows the interest rate. Remember, it's a "stable" model, meaning it has that "long run neutrality" in it, as a result of rational expectations.

These are the paths of inflation and interest rates after a one-time shock. As you interpret history, remember that every day is a new shock, and more shocks will come. Also the models are incredibly simplified, and obvious modifications add more realistic dynamics.

Ok, enough review. On the basis of the top graph, I thought inflation might well decline on its own, with interest rates staying below inflation, at least as long as we don't have another big fiscal blowout.

But now, the Fed is starting to respond (the novelty of today's post). How does that change things? Well, add the bottom graph to the top graph, really. As the Fed responds to inflation, that brings down current inflation -- a good thing -- but raises future inflation. With no change in fiscal policy, the Fed can rearrange inflation over time, but it can't get rid of the inflation that must eat away at the debt. It faces "unpleasant arithmetic" in Sargent and Wallace's famous view, though this is "unpleasant interest rate arithmetic" rather than "unpleasant monetarist arithmetic."

Another way to put it is that the Fed is starting to follow a Taylor rule, reacting to inflation by raising interest rates.

So, what happens? In these incredibly simplistic models, I simulated the response to a fiscal shock when the Fed does respond by raising interest rates, effectively automatically adding the bottom graph to the top graph. Here you go:

The solid inflation and output lines, and the lower solid interest rate line, repeat the top panel of the previous graph -- the effect of a fiscal policy shock if the Fed does nothing. The "with policy rule" lines with markers show what happens after a fiscal shock if the Fed instead follows a Taylor-type rule, interest rate = 0.9 times inflation. As you see in the blue line with markers, the interest rate now rises, in response to inflation, as the Fed is now doing. The result of that interest rate rise, per lower previous graph, is to bring down current inflation, at the cost of making inflation more persistent.

In the New-Keynesian model underlying all of this, the Fed's reaction is a good thing, even though it does not eliminate inflation. By lowering inflation, it reduces the effect of inflation on output via the Phillips curve. In this Phillips curve, inflation = expected future inflation + k x output gap, so a random-walk inflation is the best thing for stabilizing output. A Taylor rule with a 1.0 coefficient would do that. In adaptive expectations models, the Taylor rule brings stability. In new-Keynesian rational expectations models, it brings determinacy. In this fiscal theory new-Keynesian model, it reduces output and inflation volatility. The answer is the same, the questions change (rather drastically). That model robustness is a good thing, not an insult.

So, roughly speaking, here we are. Yes, my simulation supposes that the Fed reacts instantly, where it has taken a while. And reality has had multiple "shocks." So squint a bit. The lesson I see is that by adding higher interest rates a bit later in the game, the Fed is bringing inflation down (second graph) not just blunting inflation is it would have done had it moved earlier. But without progress on fiscal policy (a negative of the top graph), inflation will only subside to something like 4%, and then stick there rather stubbornly -- the right hand side of the last graph is the cost of blunting inflation now.

The episode is not totally an "experiment," as this seems to be the same forecast that others arrive at by other means. "Team transitory" thinks we had supply shocks that are fading, so inflation can go away without big interest-rate increases, but slow-moving expectations have risen. That view is not totally consistent, as with adaptive expectations, the period of no interest rate movement should have led to additional pressure on inflation. As they (or their intellectual ancestors) did in the 1980s, they think the Phillips curve pain of reductions will be too large, and are arguing that we should just get used to it and raise the inflation target. The option of a painless disinflation by fixing the long-run fiscal problem isn't in that worldview. But in any case, we get to roughly the same path going forward.

1975 may be a good historical precedent to think about. The Fed acted more quickly that it is doing now, but still never raised interest rates substantially above inflation as it did in 1980-1982. Nonetheless, inflation did fade. But it never got all the way back to its previous value, and then took off again with additional shocks in the late 1970s.